The Huge Impact a small change can make over the long term

When it comes to projecting your superannuation balance, it’s as easy as 1, 2, 3:

1️⃣ Contributions received. This is usually made up of a combination of what your employer contributes on your behalf and any additional voluntary contributions you make yourself. Making super contributions can have some tax benefits, but you must only do so within the legislated contribution caps each year.

2️⃣ Timeframe. This is the time between now and when you need to access it (although even after you retire it will still work for you). It can be variable, but typically people are able to access it from age 60 if retired or otherwise from age 65. When you choose to start accessing it can have a huge impact on the balance.

3️⃣ Rate of return achieved. Typically, higher rates of return come from growth assets such as shares and property. Whilst they offer a higher rate of return over the long term they also come with increased volatility (your amount your balance fluctuates).

Unfortunately, the industry uses the terminology “high risk” assets which can give people the wrong idea about them. To the industry it means more volatility, but some investors think it means they will lose all their money, which is far from the truth.

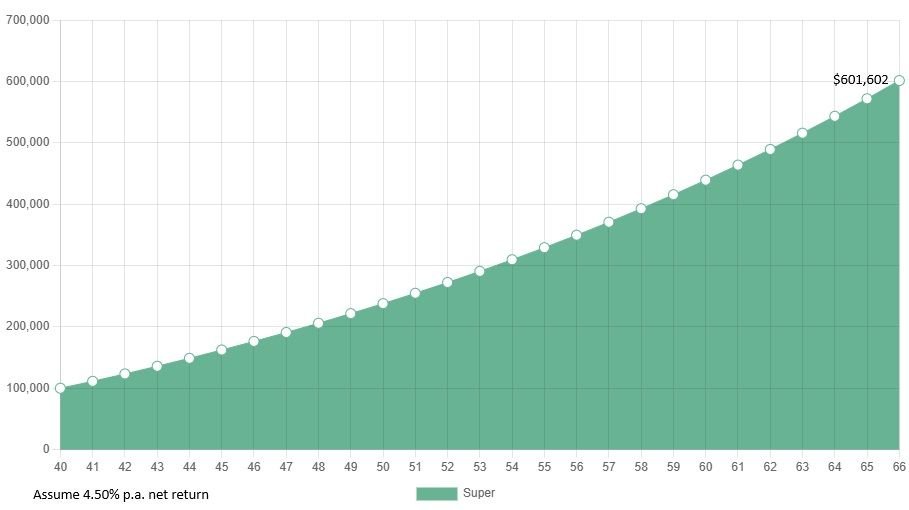

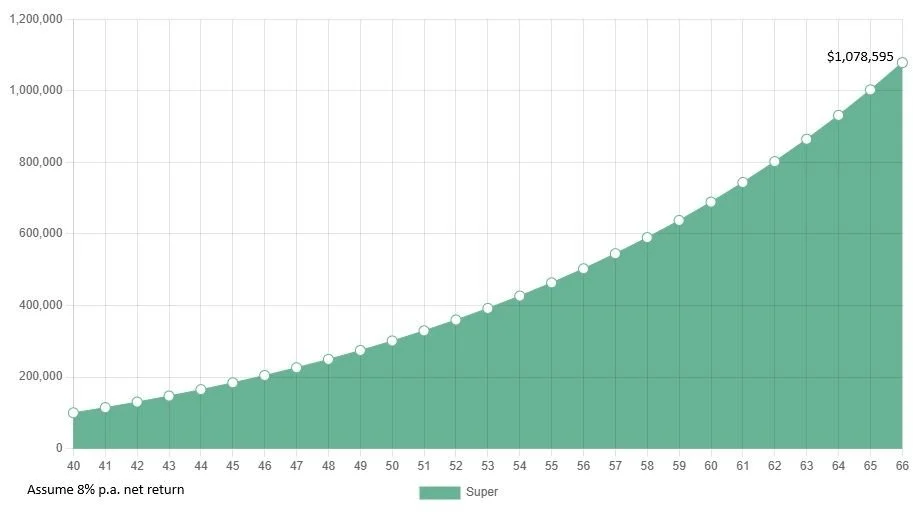

Here we have Taylor, a 40-year-old who has $100k in super and earns $75k p.a. Taylor wanted to know what impact it would have choosing an investment with a rate of return of 4.5% p.a. or 8% p.a. assuming only super guarantee is contributed.

You can see below, if Taylor chooses a more conservative approach, a projected balance of around $601,500 at age 67. However, if Taylor chooses an investment with the higher rate of return, we see a projected balance of a little over $1,000,000 (assumptions apply).

This can have a huge impact on Taylor’s retirement lifestyle and ability to meet cost of living in retirement.

Education is a huge component of what a financial advisor does. If you’re looking to obtain quality holistic financial advice in 2025 send me a message for a complimentary phone call to see if we’re a good match.

Taking a more conservative approach gave Taylor a balance of around $600k

By choosing an investment with an 8% p.a. return Taylor could end up with more than $1,000,000