Myth: Superannuation is only important when you’re close to retirement.

As we approach the end of the financial year, conversations with clients about superannuation contributions have become a daily occurrence. While most people recognise super as a long-term investment for retirement, many question whether topping it up now is worth the trade-off - especially when considering mortgage repayments or treating themselves to a holiday.

Why Invest in Superannuation?

The super environment offers powerful financial advantages that go beyond simple savings. Here are three key benefits:

✅ Immediate Tax Savings – Contributions (up to a certain limit) are tax-deductible in the financial year they’re made, reducing your taxable income now.

✅ Lower Ongoing Tax Rates – While you're working, earnings inside super are taxed at just 15%, significantly lower than many personal tax rates. At retirement (after age 60), those earnings become tax-free, providing tax advantages both now and in the future.

✅ Tax-Free Withdrawals in Retirement – Once you begin accessing your super (after age 60), your funds are returned to you tax-free, ensuring maximum financial efficiency later in life.

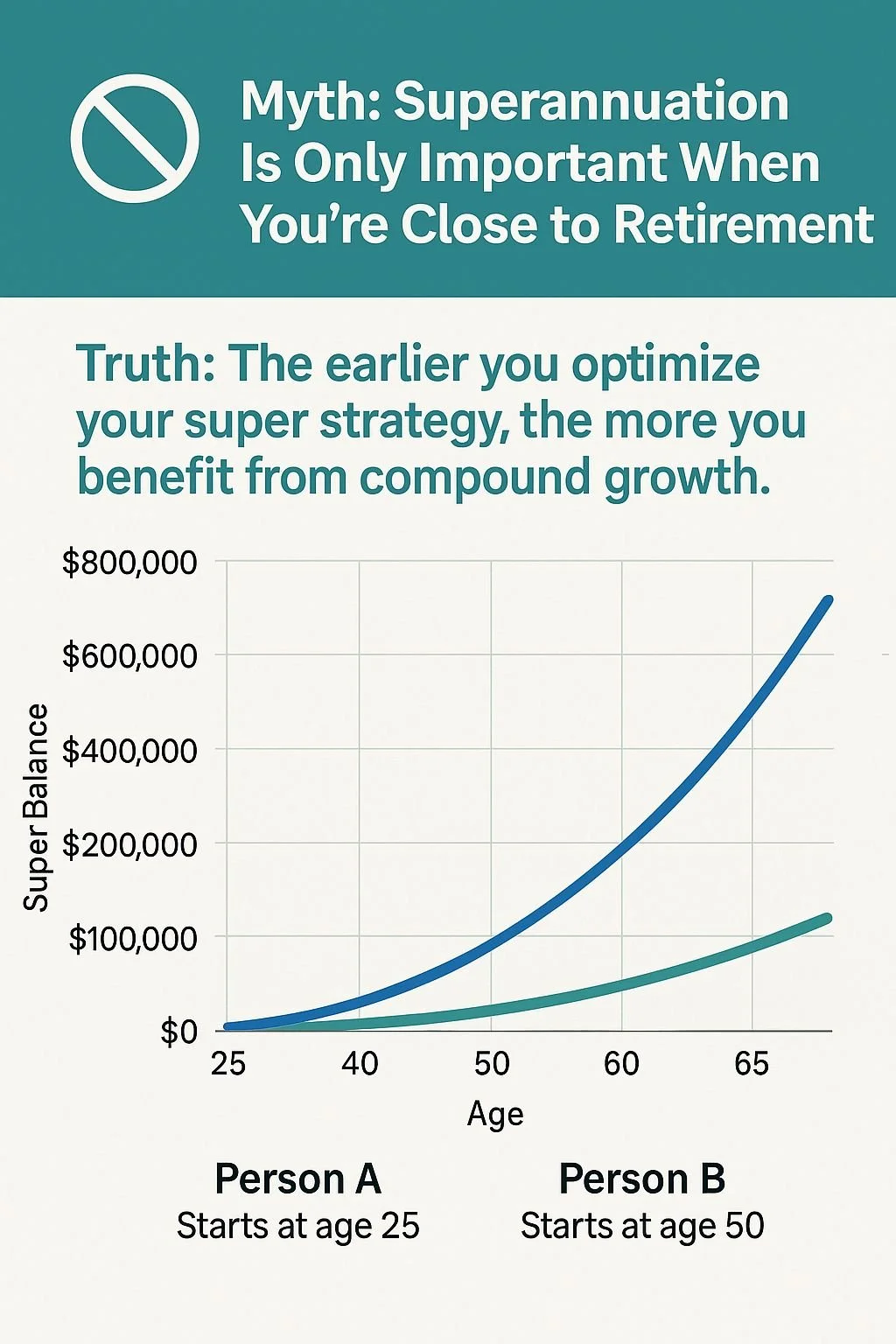

🚫 Myth: “Superannuation Only Matters When You're Close to Retirement”

✅ Truth: The earlier you optimise your super strategy, the greater the long-term benefits—thanks to compound growth.

Take Bob & John as an example:

* Bob started contributing modest amounts into super at age 25.

* John waited until age 50 to contribute larger amounts.

Even though Bob and John contribute the same total amount, Bob’s early start allows compound growth to work in his favor, leading to a significantly higher balance by retirement.

💡 Optimising your super contributions now can give you financial flexibility later. Need guidance on the best super strategies for your situation? Let’s talk.